I. Introduction

A brief overview of the significance of the Chase Mobile App in modern banking.

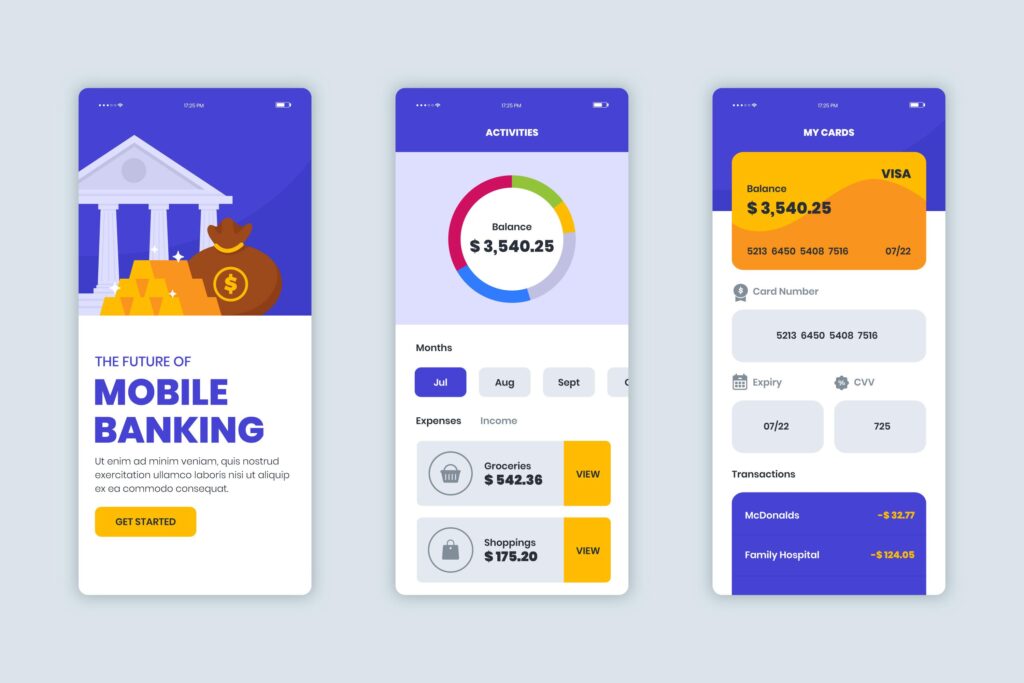

- Convenience and Accessibility: The Chase Mobile App epitomizes the changing landscape of banking, offering unparalleled convenience. It allows users to access their accounts, conduct transactions, and manage finances anytime, anywhere, using their smartphones or tablets. This 24/7 accessibility is particularly crucial in a world where people are increasingly reliant on their mobile devices for various activities.

- Streamlined Banking Experience: Physical bank branches no longer require waiting in long queues. The app streamlines banking processes, enabling users to perform various tasks efficiently without the need to visit a bank. Users can check their account balances, transfer funds, pay bills, deposit checks, and manage their investments with just a few taps on their mobile devices. This streamlined experience saves time and enhances overall efficiency.

- Enhanced Security Measures: In the realm of modern banking, security is paramount. The Chase Mobile App integrates advanced security features, such as biometric authentication (fingerprint or Face ID), two-factor authentication, and real-time fraud monitoring. These features provide users with a secure environment for managing their finances, instilling confidence in the safety of their transactions.

- Personalized User Experience: The app offers a tailored experience, allowing users to customize their preferences, set up notifications, and personalize their dashboard according to their specific needs. This personalization ensures that users have easy access to the features they use most frequently, creating a more user-friendly interface.

- Integration of Innovative Features: Chase continues to introduce innovative features within the app to enhance the overall banking experience. These include tools for budgeting, goal setting, and tracking spending habits. Additionally, the app seamlessly integrates with other Chase services, such as credit cards and investment accounts, providing users with a comprehensive financial management platform.

- Adaptation to Changing Consumer Behavior: The Chase Mobile App’s significance also lies in its adaptation to changing consumer behaviors. With the increasing reliance on digital platforms for various tasks, including banking, the app caters to the evolving preferences of customers who seek convenience, speed, and simplicity in managing their finances.

In summary, the Chase Mobile App’s significance in modern banking is underscored by its ability to provide a convenient, secure, and personalized banking experience, effectively meeting the needs and expectations of users in an era characterized by rapid technological advancements and changing consumer behaviors.

Introduce the purpose of the blog post – to provide users with essential tips and tricks to optimize their experience with the app.

The primary objective of introducing the purpose of the blog post—providing users with essential tips and tricks to optimize their experience with the Chase Mobile App—is to offer valuable guidance and insights that empower users to make the most of the app’s features. Here’s a detailed explanation:

- Empowering Users: The purpose of the blog post is to empower users by offering a comprehensive guide on how to optimize their experience with the Chase Mobile App. By sharing essential tips and tricks, the post aims to equip users with the knowledge and skills necessary to navigate the app effectively. This empowerment enables users to take full advantage of the app’s functionalities, enhancing their overall banking experience.

- Enhancing User Experience: The blog post seeks to enhance the user experience by providing tips and tricks that can streamline interactions with the Chase Mobile App. It aims to make users more proficient in utilizing various features, simplifying tasks, and ultimately making their banking experience more efficient and enjoyable.

- Maximizing App Utility: The goal is to maximize the utility of the Chase Mobile App for users. By imparting tips and tricks, the blog post intends to highlight often-overlooked or underutilized features, ensuring that users can leverage the app’s full potential. This may include shortcuts, hidden functions, or innovative ways to perform tasks, ultimately saving time and effort for the users.

- Addressing User Needs: Recognizing that users might encounter challenges or overlook certain aspects of the app, the blog post aims to address these needs. It strives to anticipate common difficulties or areas where users might benefit from additional guidance, offering practical solutions through the provided tips and tricks.

- Encouraging Engagement: By offering valuable insights and advice, the blog post aims to foster engagement with the Chase Mobile App. Users are encouraged to explore the app more confidently, experiment with its features, and engage with their finances in a manner that aligns with their specific needs and preferences.

- Increasing Confidence and Competence: The post aims to boost users’ confidence and competence in using the app. By providing clear and actionable tips, users can develop a deeper understanding of the app’s functionalities, leading to increased confidence in managing their finances and utilizing the app to its fullest potential.

In essence, the purpose of the blog post is to serve as a comprehensive guide, offering users practical tips and tricks that will not only facilitate smoother navigation of the Chase Mobile App but also enhance their overall banking experience, fostering a sense of confidence and proficiency in using the app.

II. Setting Up Your Account

Step-by-step guide on how to create a Chase Mobile App account.

Creating a Chase Mobile App account is a fundamental step toward accessing and managing your banking activities on the go. Here’s a detailed step-by-step guide on how to create a Chase Mobile App account:

1. Download and Install the App:

- Visit the App Store (for iOS devices) or the Google Play Store (for Android devices).

- Search for “Chase Mobile” in the app store and select the official Chase Mobile App.

- Download and install the app on your smartphone or tablet.

2. Launch the App:

- Locate the Chase Mobile App icon on your device and tap to open it.

3. Register for an Account:

- On the app’s homepage, you’ll find options like “Sign In” or “Get Started.” Click on “Get Started” to create a new account.

4. Enter Personal Information:

- You’ll be prompted to enter personal details such as your full name, email address, and Social Security number.

5. Verify Identity:

- The app may ask you to verify your identity. This can be done through various methods, such as entering your Chase account number or providing other identification details.

6. Set Up Username and Password:

- Create a unique username and a strong password for your account. Ensure that the password meets the required security standards.

7. Accept Terms and Conditions:

- Review the terms and conditions presented by Chase. Once you agree to them, proceed by clicking “Accept” or a similar button.

8. Secure Your Account:

- Set up additional security measures, such as setting up security questions or enabling biometric authentication if available (e.g., fingerprint or Face ID).

9. Complete the Setup Process:

- Follow any additional prompts to finalize the setup process. You might be asked to link an existing Chase account if you have one.

10. Confirmation and Verification:

- Once you’ve completed all the necessary steps, you’ll receive a confirmation message indicating that your Chase Mobile App account has been successfully created.

11. Sign In:

- Use the newly created username and password to sign in to your newly created Chase Mobile App account.

Additional Notes:

- Make sure to keep your login credentials secure and confidential.

- If you encounter any issues during the account creation process, Chase’s customer support can provide assistance.

- Remember to update the app regularly to access the latest features and security enhancements.

Explaining the importance of setting up account preferences for a personalized experience.

Setting up account preferences in the Chase Mobile App is crucial as it allows users to personalize their banking experience according to their specific needs and habits. Here’s a detailed explanation of the importance:

- Tailored User Experience: Setting up account preferences enables users to tailor their interaction with the app, ensuring that the most relevant and frequently accessed information is readily available. This customization can include choosing favorite accounts, setting default actions, or organizing features based on personal preferences.

- Quick and Efficient Access: By pre-selecting certain preferences, users can expedite their banking tasks. For instance, designating a primary account or favorite transactions streamlines the process, reducing the time spent navigating the app and making it more user-friendly.

- Customized Notifications: Account preferences allow users to set up notifications according to their preferences. Users can opt to receive alerts for specific activities such as deposits, withdrawals, low balances, bill payments, or account updates. These personalized alerts help users stay informed about their finances without being inundated with unnecessary notifications.

- Enhanced Security Measures:Account preferences often include settings for additional security measures. Users can choose to enable two-factor authentication, biometric login, or set up security questions, bolstering the overall security of their accounts and providing peace of mind.

- Simplified Transactions: Customizing account preferences can simplify and streamline transactions. For example, setting a default account for payments or transfers reduces the steps needed for these actions, making transactions more efficient and reducing the likelihood of errors.

- Focus on Individual Financial Goals: The ability to personalize the app allows users to align it with their financial goals. Whether it’s saving for a specific purpose, managing expenses, or tracking investments, setting up account preferences helps in focusing on individual financial aspirations.

- User-Friendly Interface: A personalized experience through account preferences creates a user-friendly interface. Users are more likely to engage with an interface that aligns with their habits and preferences, fostering a positive experience and encouraging more frequent use of the app.

- Adaptation to User Behavior: By analyzing user preferences and habits through these settings, the app can adapt and provide more relevant suggestions or tools, creating a more intuitive and user-centric experience over time.

In summary, setting up account preferences in the Chase Mobile App is vital as it allows users to customize their experience, making banking more efficient, secure, and aligned with their specific financial goals and habits. This personalization fosters a more user-friendly, tailored experience, ultimately enhancing the overall banking experience.

Security features and tips for creating a strong password/PIN

Ensuring robust security for your Chase Mobile App account is essential to safeguard your financial information and prevent unauthorized access. Here’s a detailed explanation of security features and tips for creating a strong password or PIN:

Importance of Strong Passwords/PINs:

- Protection Against Unauthorized Access: Strong passwords or Personal Identification Numbers (PINs) act as a primary line of defense, preventing unauthorized individuals from gaining access to your account.

- Securing Sensitive Information: Your Chase Mobile App account contains sensitive financial data. A strong password or PIN helps protect this information from potential threats like identity theft or fraudulent activities.

Security Features and Tips:

- Complexity and Length: Create passwords or PINs that are complex and difficult for others to guess. Use a combination of uppercase and lowercase letters, numbers, and special characters. Aim for a minimum length of 12 characters for passwords.

- Avoid Personal Information: Refrain from using easily guessable information such as your name, birthdate, or common words in your passwords. This information can be easily obtained or guessed by attackers.

- Unique Passwords/PINs: Avoid using the same password/PIN across multiple accounts. Create unique combinations for different accounts, including your Chase Mobile App, to prevent a single breach from compromising multiple accounts.

- Frequent Password/PIN Updates: Change your password or PIN regularly. Regular updates prevent unauthorized access in case the current password/PIN is compromised.

- Enable Two-Factor Authentication (2FA): Where available, enable 2FA. This adds an extra layer of security, requiring a second form of verification, such as a code sent to your phone or email, in addition to your password/PIN.

- Biometric Authentication: If your device supports it, use biometric authentication like fingerprint or facial recognition. This offers a convenient and secure way to access your account.

- Avoid Shared or Public Devices: Refrain from accessing your Chase Mobile App account on shared or public devices where your credentials might be compromised or saved without your knowledge.

- Secure Login Information: Ensure that your password or PIN is stored securely and not shared with anyone. Avoid writing it down in easily accessible locations.

- Keep Software Updated: Ensure that both your Chase Mobile App and your device’s operating system are regularly updated. These updates often include security patches and enhancements.

- Monitor Account Activity: Regularly review your account for any unusual or unauthorized activity. If you suspect any unauthorized access, report it to Chase immediately.

By implementing these security measures and creating a strong, unique password or PIN, users can significantly enhance the security of their Chase Mobile App account, reducing the risk of unauthorized access and protecting their sensitive financial information.

III. Navigating the Interface

Exploring the main features and tabs within the app.

Exploring the main features and tabs within the Chase Mobile App is essential to understand the full range of functionalities it offers for managing your finances. Here’s a detailed breakdown of the key features and tabs you’ll encounter:

1. Account Overview:

- This section provides a snapshot of your accounts, including checking, savings, credit cards, loans, and investments. It displays account balances, recent transactions, and alerts for account activities.

2. Transfers:

- Allows you to transfer funds between your different accounts, both within Chase and to external accounts. You can schedule one-time or recurring transfers and manage them effortlessly.

3. Bill Pay:

- Enables you to pay bills directly from your Chase account. You can set up payees, schedule payments, and manage your recurring bills in a convenient and organized manner.

4. Deposit Checks:

- This feature allows you to deposit checks by taking photos of them using your mobile device. It’s a convenient alternative to visiting a physical bank location.

5. Card Management:

- Manages your credit and debit cards. You can activate new cards, lock or unlock your cards in case of loss or theft, set spending limits, and manage card benefits.

6. Account Statements:

- View and download digital copies of your account statements. You can access historical statements for all your accounts.

7. Notifications and Alerts:

- Set up and manage notifications for account activities, such as low balance alerts, large transactions, or payment reminders. Customize alerts based on your preferences.

8. Customer Service:

- Access customer support features, including FAQs, chat support, and phone contact options for addressing any queries or issues.

9. Zelle and QuickPay:

- Enables quick and easy money transfers to friends or family using Zelle or QuickPay, which allows for peer-to-peer payments directly from your account.

10. Security Features:

- Manage additional security settings such as enabling two-factor authentication, setting up touch ID or Face ID, and reviewing account-specific security measures.

11. Special Offers and Rewards:

- Explore any rewards, offers, or special deals provided by Chase. This section showcases tailored offers or benefits for specific account holders.

12. Settings and Preferences:

- Customize your app settings, such as language preferences, account nicknames, login preferences, and other personalization options.

13. Search Functionality:

- Allows you to quickly find transactions, payees, or any specific information within the app, making navigation more efficient.

Understanding and familiarizing yourself with these main features and tabs within the Chase Mobile App ensures that you can efficiently manage your financial activities, access key account information, and take advantage of the diverse functionalities provided by the app, thereby enhancing your overall banking experience.

Tips on how to navigate seamlessly between accounts, transactions, payments, and statements.

Navigating seamlessly between accounts, transactions, payments, and statements within the Chase Mobile App is essential for efficiently managing your finances. Here are tips to streamline your navigation through these key sections:

1. Familiarize Yourself with the App Layout:

- Spend some time exploring the app’s layout and structure. Understand where the different sections, such as accounts, transactions, payments, and statements, are located within the app.

2. Account Switching:

- Utilize the account switch feature, typically found in the top or sidebar menu, to seamlessly move between different accounts. This avoids logging out and back in, enabling quick access to multiple accounts.

3. Quick Account Overviews:

- Set favorite or frequently used accounts for quick access. Most apps allow users to pin or mark specific accounts, allowing for a quick overview without navigating through multiple screens.

4. Transaction Search and Filters:

- Use the search or filter options within the transaction section to find specific transactions quickly. Filters often include date ranges, transaction types, or amounts, making it easier to locate specific transactions.

5. Scheduled Payments and Transactions:

- For recurring or scheduled payments, ensure you regularly review and manage them to avoid any unexpected issues. The app often has a designated section for scheduled or recurring transactions.

6. Statements and Document Retrieval:

- Access digital statements or documents by navigating to the designated ‘Statements’ or ‘Documents’ section. Ensure you’re familiar with how to retrieve past statements or important documents if needed.

7. Set Up Alerts and Notifications:

- Customize alerts and notifications for specific activities or transactions. This helps in staying informed about account activities without continuously checking the app.

8. Leverage Quick Actions:

- Many apps offer quick action buttons within account summaries. For example, tapping on an account balance might reveal options for quick transfers or payments related to that account.

9. Understanding Payment Workflows:

- Familiarize yourself with the steps involved in making payments. Understand the workflow for initiating payments, choosing payees, and setting up payment frequencies.

10. Utilize In-App Help or FAQs:

- Explore the app’s help section or FAQs if you’re unsure about any specific function. Most apps provide detailed information on how to navigate and utilize their various features.

11. Keep the App Updated:

- Ensure the app is regularly updated to access new features, bug fixes, and enhancements. Updated versions often streamline navigation and improve user experience.

By incorporating these tips, users can efficiently navigate between accounts, transactions, payments, and statements within the Chase Mobile App, ensuring a smoother and more effective management of their financial activities.

Customizing the interface for quick access to frequently used options.

Customizing the interface of the Chase Mobile App allows users to personalize their experience by arranging and accessing frequently used features or options more conveniently. Here’s an in-depth explanation:

1. Favorite Accounts or Transactions:

- The app often allows users to mark certain accounts or transactions as favorites. Users can pin or star these options for quick access, typically placing them at the top of the interface or on the homepage for immediate visibility.

2. Customizing Dashboard or Homepage:

- Some apps permit customization of the app’s homepage or dashboard. Users can rearrange or add widgets, tiles, or shortcuts for specific features, accounts, or transactions they use frequently, making them easily accessible.

3. Setting Default Actions:

- Users can set default actions for specific features. For instance, setting a default account for transfers or payments streamlines the process, reducing the number of steps needed for these transactions.

4. Quick Access Shortcuts:

- Customize the app to include shortcuts or direct links to often-used features or actions. This might include shortcuts to transfer funds, pay bills, or view account balances directly from the main interface.

5. Personalized Menus or Toolbars:

- Some apps allow users to rearrange menus or toolbars according to their preferences. Rearranging these elements can facilitate quick access to preferred sections or actions.

6. Hide Unused Features:

- If certain features are seldom used, consider customizing the interface by hiding or removing these options. This declutters the interface, emphasizing the features you use frequently.

7. Widget Customization:

- On compatible devices, users can add specific widgets to their device’s home screen for quick access to account balances, recent transactions, or other preferred information without opening the app.

8. Setting Notifications and Alerts:

- Customize and prioritize notifications for specific activities or transactions. Adjusting the notification settings ensures that alerts for crucial activities are readily visible.

9. Personal Preferences:

- The app might provide options for personal preferences, such as language settings, color schemes, or font sizes. Tailoring these preferences can create a more user-friendly interface.

10. Testing and Adjusting:

- Experiment with different customizations to find the setup that works best for you. The app’s flexibility often allows for trial and error in finding the most efficient layout for your needs.

By customizing the interface of the Chase Mobile App, users can optimize their experience by prioritizing and accessing frequently used features or options more conveniently. This personalization enhances efficiency and user satisfaction, enabling quicker navigation and smoother interactions with the app.

IV. Making Transactions

How to make simple and advanced transactions using the app

Absolutely, using the Chase Mobile App, you can perform a wide range of both simple and advanced transactions conveniently. Here’s an explanation on executing these types of transactions within the app:

Simple Transactions:

- Transferring Funds Between Accounts: Within the app, locate the “Transfers” section. Select the accounts you want to transfer money between, enter the amount, and confirm the transfer.

- Paying Bills: Access the “Bill Pay” section. Set up your payees, enter the payment amount, schedule the payment date, and complete the transaction.

- Deposit Checks: Use the “Deposit Checks” feature to take photos of the front and back of the check. Follow the on-screen prompts to capture the check images, enter the check amount, and submit the deposit.

- Check Balances and Review Transactions: Navigate to the account overview or specific account tabs to check balances or review recent transactions. This provides a quick snapshot of your financial activity.

Advanced Transactions:

- Wire Transfers: Look for the wire transfer option within the “Transfers” section. Provide the recipient’s details, including account information and amount, and follow the steps to initiate the transfer.

- Setting Up Recurring Payments: In the “Bill Pay” section, look for the option to set up recurring payments. Choose the payee, payment amount, and frequency of payments, such as weekly, monthly, etc.

- Managing Investments or Trading: If you have investment accounts linked to your Chase profile, navigate to the “Investments” section. View account details, trade stocks, manage portfolios, or conduct other investment-related activities.

- Loan Payments or Mortgage Management: If you have loans or mortgages with Chase, locate the specific sections for loans or mortgages within the app. Make payments, check loan details, or access mortgage information.

- Foreign Currency Transactions: For foreign currency transactions, find the relevant section for international transfers or currency exchange. Provide the recipient’s information and the desired foreign currency details.

Tips for Advanced Transactions:

- Verify Details: For more advanced transactions like wire transfers or investments, double-check all details before confirming the transaction.

- Stay Informed: Understand the terms and conditions, fees, and processing times for advanced transactions to make informed decisions.

- Use Secure Connections: Ensure you’re using a secure internet connection, especially for transactions involving sensitive financial details.

- Utilize Help and Support: If uncertain about any advanced transaction, utilize the app’s help section, FAQs, or customer support for guidance.

By leveraging the various features within the Chase Mobile App, users can perform both simple and advanced transactions efficiently, offering a comprehensive suite of options for managing their financial activities.

Tips for scheduling payments or setting up recurring transactions.

Scheduling payments or setting up recurring transactions within the Chase Mobile App is an efficient way to manage bills and regular expenses. Here are detailed tips for scheduling and managing recurring payments:

1. Scheduling Payments:

- Timely Planning: Plan your payments in advance, considering due dates and processing times to ensure they are completed on time.

- Selecting the Payee: Choose the payee or recipient for the payment. Ensure accurate entry of their information to avoid any misdirected payments.

- Setting Payment Amount: Enter the exact payment amount to be transferred, ensuring it matches the intended payment or bill.

- Scheduling Date: Choose the date for payment processing. Ensure it allows enough time for the payment to reach the recipient before the due date.

- Review and Confirm: Before confirming the scheduled payment, review all the entered details for accuracy and completeness.

2. Setting Up Recurring Transactions:

- Selecting Frequency: Choose the frequency for recurring payments, whether it’s weekly, bi-weekly, monthly, etc., based on the payment schedule.

- Consistent Payment Amount: Ensure a consistent payment amount for recurring transactions unless specific adjustments are needed for varying bills or payments.

- Account Balance Review: Regularly review your account balance to ensure sufficient funds are available for recurring payments to avoid overdrafts or failed transactions.

- Payment End Dates: Set an end date for recurring payments if they’re temporary or have a specific duration. This prevents unwanted payments after a certain period.

- Notification Settings: Consider setting up notifications or alerts for when recurring payments are processed to stay informed about transaction activities.

Tips for Effective Payment Scheduling and Recurring Transactions:

- Consistency and Regular Review: Regularly review your scheduled payments and recurring transactions to ensure they align with your financial needs and budgets.

- Update Information: Update payee information or payment amounts if there are changes to avoid any discrepancies or failed payments.

- Account Monitoring: Continuously monitor your accounts to confirm that scheduled payments or recurring transactions are processed correctly without any issues.

- Plan Ahead for Changes: If changes are needed, make adjustments in the app promptly, ensuring that scheduled or recurring payments reflect the updated information.

- Leverage Customer Support: If there are uncertainties or changes in the payment setup, use the app’s customer support or help sections for guidance and assistance.

By applying these tips for scheduling payments and setting up recurring transactions within the Chase Mobile App, users can effectively manage their bills and regular expenses, ensuring payments are made on time and in accordance with their financial needs and schedules.

Using the app for financial planning and budgeting.

Utilizing the Chase Mobile App for financial planning and budgeting can be a powerful way to manage your money effectively. Here’s a comprehensive explanation of how you can leverage the app for these purposes:

1. Monitoring Transactions:

Review your transactions regularly using the app. Categorize expenses to track where your money is going. This helps in understanding spending patterns and identifying areas where you can cut costs or adjust your budget.

2. Setting Budgets:

- The app often allows users to set budget limits for different spending categories. Allocate specific amounts for groceries, entertainment, bills, etc. Track your spending against these limits to stay within budget.

3. Expense Tracking:

- Utilize the app’s expense tracking features to see a clear breakdown of where your money is being spent. Analyze trends over time to make informed financial decisions.

4. Goal Setting:

- Set financial goals within the app, such as saving for a vacation, paying off debts, or creating an emergency fund. Monitor progress towards these goals and adjust your spending to align with your objectives.

5. Reports and Insights:

- Explore the app’s reporting tools and insights. Many apps provide summaries or visual representations of your financial health, making it easier to comprehend your financial situation.

6. Alerts for Overspending:

- Configure alerts to notify you when you’re nearing or exceeding budget limits in certain categories. This prompts you to reevaluate your spending in real-time.

7. Saving Features:

- Some apps offer round-up features where transactions are rounded up to the nearest dollar, and the spare change is automatically deposited into a savings account. This fosters a habit of saving without much effort.

8. Analyzing Trends and Patterns:

- Utilize the app’s tools to analyze your financial trends and patterns over time. Understand your spending habits and adjust as needed to achieve financial stability.

9. Debt Management:

- Use the app to manage and track debts, such as credit card balances, loans, or mortgages. Visualizing and keeping track of these debts can help in developing repayment strategies.

10. Financial Education and Resources:

- Some apps provide financial education resources or tools to improve financial literacy. Take advantage of these resources to better understand personal finance management.

Tips for Effective Financial Planning and Budgeting Using the App:

Regular Check-ins:

- Schedule regular check-ins within the app to monitor your progress, adjust budgets, and realign your financial goals.

Adjustments and Flexibility:

- Be open to making adjustments as your financial situation evolves. Your budget and goals might change over time, and the app allows for this flexibility.

Stay Disciplined:

- Stick to your budget and financial goals, and use the app as a tool to maintain financial discipline and accountability.

Seek Assistance:

- If you’re uncertain about certain features or need advice, leverage the app’s customer support or financial resources available within the app.

Leveraging the features within the Chase Mobile App for financial planning and budgeting can provide valuable insights, help manage expenses, and contribute to better financial decision-making, ultimately leading to improved financial wellness and stability.

V. Managing Accounts and Security

Understanding account notifications and alerts for better financial control

Understanding account notifications and alerts within the Chase Mobile App is essential for maintaining better financial control. These alerts play a significant role in managing your finances. Here’s a detailed breakdown:

1. Types of Notifications and Alerts:

- The app offers various alerts, including low balance warnings, large transactions, bill due reminders, account activity notifications, and security alerts. Each serves to keep you informed about different aspects of your financial activities.

2. Customization Options:

- Users can customize and set preferences for the types of alerts they want to receive. This allows you to tailor notifications to match your specific needs and preferences.

3. Timely Updates:

- Notifications are sent in real-time or near-real-time, ensuring that you’re promptly informed about crucial account activities or events.

4. Budgetary Control:

- Alerts for nearing or exceeding budget limits in specific categories assist in better budget management. They prompt you to reevaluate spending patterns and maintain better control over your finances.

5. Fraud Prevention and Security:

- Alerts for suspicious account activities, such as unrecognized transactions or logins, help in identifying potential fraud or unauthorized access. This ensures timely action to protect your account.

6. Bill Reminders and Due Dates:

- Notifications for bill due dates ensure you’re aware of upcoming payments, reducing the risk of missing payments and incurring late fees.

7. Large Transaction Alerts:

- Alerts for significant or unusual transactions serve as a safeguard against unauthorized or unexpected large expenses, prompting you to verify such activities.

8. Convenience and Control:

- Notifications and alerts provide convenience, keeping you in control of your financial situation without needing to frequently check your account.

9. Regular Account Monitoring:

- They encourage regular monitoring of your accounts, fostering a more engaged and informed approach to financial management.

Tips for Maximizing Account Notifications and Alerts:

Customization for Relevance:

- Tailor notifications to your specific needs, focusing on alerts that are most relevant and useful for your financial control.

Regular Review and Action:

- Regularly review alerts and take necessary action, whether it’s reviewing transactions, paying bills, or addressing security concerns.

Stay Informed and Updated:

- Be aware of the types of alerts available and ensure you are up-to-date with any changes or new alert options provided by the app.

Utilize Security Alerts Promptly:

- Respond promptly to security-related alerts to address any potential threats or unauthorized activities.

By understanding and effectively utilizing account notifications and alerts within the Chase Mobile App, users can significantly enhance their financial control, stay informed about their financial activities, and proactively manage their accounts, leading to better financial well-being and security.

Tips for managing account security – enabling two-factor authentication, setting up touch/Face ID, etc

Ensuring robust account security within the Chase Mobile App is crucial for safeguarding your financial information. Here’s a comprehensive explanation of tips for managing account security using features such as two-factor authentication and biometric identification like Touch ID or Face ID:

1. Enable Two-Factor Authentication (2FA):

- Activate two-factor authentication, where available, to add an extra layer of security. This typically involves receiving a verification code through text, email, or an authenticator app after entering your password.

2. Biometric Authentication:

- Utilize biometric identification methods like Touch ID or Face ID if supported by your device. These provide secure and convenient access to your account using your fingerprint or facial recognition.

3. Strong and Unique Passwords:

- Create strong and unique passwords for your Chase account. Use a combination of uppercase and lowercase letters, numbers, and special characters. Avoid easily guessable information like birthdates or common words.

4. Regularly Update Passwords:

- Change your passwords at regular intervals to maintain security. This practice helps prevent unauthorized access even if your password is compromised.

5. Use Secure Networks:

- Always use secure and trusted networks when accessing the app. Avoid using public Wi-Fi networks for sensitive activities.

6. Device Security:

- Ensure your device is protected with a secure lock screen password or PIN. This is an added layer of security in case your device gets lost or stolen.

7. Review and Enable Security Settings:

- Explore the security settings within the app. Review and enable features such as auto-lock, inactivity timeouts, or data encryption to enhance security.

8. Manage App Permissions:

- Regularly review and manage app permissions, granting access only to necessary functions and features. Restrict unnecessary access to enhance overall security.

9. Stay Informed about Security Updates:

- Keep the Chase Mobile App updated to access the latest security patches and enhancements. Updated versions often include improved security measures.

10. Use Verified Links and Official Sources:

- When prompted to enter sensitive information, ensure you are using verified and official links or sources. Be cautious of phishing attempts or suspicious links.

Tips for Effective Account Security Management:

Consistent Monitoring:

- Regularly monitor your account for any unusual activity or transactions. Report anything suspicious immediately.

Education and Awareness:

- Stay informed about current security threats and fraud tactics to better protect your account.

Utilize Customer Support:

- If you have any security concerns or need assistance, contact Chase’s customer support for guidance.

By implementing these tips for managing account security within the Chase Mobile App, users can significantly enhance the protection of their financial information and minimize the risk of unauthorized access or fraudulent activities.

Explaining how to report and address any suspicious activities promptly

Reporting and addressing any suspicious activities promptly within the Chase Mobile App is crucial for maintaining the security of your financial accounts. Here’s a detailed explanation on how to address such concerns:

1. Recognizing Suspicious Activity:

- Be vigilant and attentive to any irregularities in your account, such as unknown transactions, unrecognized logins, unexpected changes in balances, or unfamiliar account activities.

2. Immediate Action:

- Upon detecting any suspicious activity, take immediate action. Promptness is key to addressing and resolving potential security threats.

3. Accessing Support Channels:

- Use the designated customer support channels provided within the app. Look for ‘Help’ or ‘Contact Us’ sections to report any concerns immediately.

4. Report Unauthorized Transactions:

- If you notice unauthorized or fraudulent transactions, report them to Chase immediately. Most apps provide a specific section for reporting such activities.

5. Freeze or Lock the Account:

- If possible within the app, freeze or lock the account to prevent further unauthorized access until the issue is resolved. This step can add an extra layer of security.

6. Change Passwords and Security Information:

- If you suspect a security breach, change your passwords and any compromised security information immediately. This prevents further unauthorized access.

7. Review and Preserve Evidence:

- Take screenshots or make notes of the suspicious activities as evidence. This documentation can assist in the investigation and resolution of the issue.

8. File a Dispute or Fraud Claim:

- If there are unauthorized transactions or fraudulent activities, file a dispute or fraud claim through the app’s designated section to start an investigation.

9. Stay Informed on Resolution Progress:

- Follow up regularly to check the progress of the reported issue. Most apps provide updates or notifications on the status of resolved cases.

10. Regularly Monitor Account Activity:

- Continuously monitor your account for any new suspicious activities even after reporting an incident. Stay vigilant to prevent reoccurrence.

Tips for Addressing Suspicious Activities Promptly:

Stay Calm and Act Quickly:

- Maintain composure and address the situation promptly without delay.

Utilize App’s Security Features:

- Utilize any additional security features within the app, such as freezing the account or setting up additional security measures.

Follow Up and Document:

- Keep track of your communications, follow-ups, and any documentation related to the reported issue for reference and future inquiries.

Educate Yourself:

- Stay informed about the common types of fraud or security threats to better recognize and prevent similar incidents in the future.

Reporting and addressing any suspicious activities promptly within the Chase Mobile App is crucial for maintaining the security of your financial accounts. By taking immediate action and utilizing the app’s support channels effectively, users can mitigate potential risks and resolve issues efficiently.

VI. Optimizing Features

Utilizing special features like QuickDeposit, QuickPay, and Zelle for efficient money management.

Here’s an in-depth explanation of these functionalities:

1. QuickDeposit:

- QuickDeposit enables users to deposit checks into their accounts conveniently using their mobile device’s camera. Users capture images of the front and back of the endorsed check, enter the deposit amount, and submit it through the app. The funds are usually available within a specified period, providing a quicker alternative to physically visiting a bank branch for check deposits.

2. QuickPay:

- QuickPay is a feature that allows users to transfer money to individuals quickly and easily. It’s ideal for payments to friends, family, or others. Users can send money by simply using the recipient’s email address or mobile number, often without incurring any fees. The recipient receives a notification and can accept the payment directly into their bank account.

3. Zelle:

- Zelle is a peer-to-peer payment service that enables fast and secure money transfers between bank accounts. It allows users to send money directly from their Chase account to recipients’ accounts at participating banks using their email or mobile number. Zelle offers real-time money transfer, making it an efficient option for sending payments, splitting bills, or sharing expenses.

Benefits and Tips for Using These Features Efficiently:

Convenience and Time-Saving:

- These features save time by eliminating the need for physical transactions, enabling users to perform banking tasks directly from their mobile devices.

Accessibility and Availability:

- The services are available 24/7, providing the flexibility to manage financial transactions at any time, enhancing accessibility and convenience.

Secure Transactions:

- These services offer secure and encrypted transactions, ensuring the safety of financial information during money transfers and check deposits.

Know the Limits and Terms:

- Be aware of transaction limits, processing times, and any associated fees for using these services. Understanding these aspects ensures smooth transactions without unexpected hiccups.

Prompt Acceptance and Confirmation:

- Advise recipients to promptly accept payments or confirm deposits to ensure the timely availability of funds, particularly in the case of QuickPay and Zelle transactions.

Regular Monitoring:

- Regularly monitor transaction histories and account balances to keep track of incoming and outgoing funds, ensuring accuracy and security.

Utilizing features like QuickDeposit, QuickPay, and Zelle within the Chase Mobile App streamlines money management, enabling efficient and secure transactions without the need for physical visits to a bank. Understanding the benefits and tips for using these features optimally ensures smoother and more effective financial management.

Tips on how to get the most out of rewards, offers, and benefits available through the app

Maximizing the rewards, offers, and benefits available through the Chase Mobile App involves strategic utilization of various features. Here’s an in-depth explanation with tips on how to get the most out of these perks:

1. Understanding Available Rewards and Offers:

- Explore the app to identify the diverse range of rewards, offers, and benefits available for different accounts or card types. These could include cashback rewards, travel points, discounts, or special promotions.

2. Utilize Linked Cards and Accounts:

- Link all eligible cards and accounts to maximize rewards. Some offers or benefits are specific to certain card types or accounts. Ensure all applicable accounts are integrated.

3. Frequent Check-ins and Notifications:

- Regularly check the app for new rewards, offers, and deals. Enable notifications to receive alerts for new promotions or benefits available to you.

4. Plan Spending Around Offers:

- Adjust spending to align with available offers or rewards. For instance, if there’s a cashback offer on groceries, plan to use the associated card for those purchases.

5. Optimize Point Accumulation:

- Understand how points or rewards are accumulated. Some cards offer extra points for specific categories such as dining, travel, or gas. Plan your spending accordingly to maximize rewards in these categories.

6. Redemption Strategies:

- Be strategic in redeeming rewards. Some redemption methods might offer better value than others. For example, using points for travel might provide more value compared to cashback.

7. Special Partner Offers:

- Take advantage of partner offers or collaborations. Some rewards programs have tie-ups with specific brands or retailers, offering enhanced benefits when using your card at these locations.

8. Time-Sensitive Offers:

- Be mindful of the expiration dates or time-limited offers. Plan your spending or redemptions to take advantage of these offers before they expire.

9. Stay Informed on Program Updates:

- Stay updated with program changes or updates to ensure you’re aware of any alterations in rewards structures or new benefits available.

10. Combine Offers and Benefits:

- Combine multiple offers or benefits when applicable. For example, stack cashback offers with specific discounts to maximize savings or rewards.

Tips for Effective Utilization of Rewards, Offers, and Benefits:

Read Terms and Conditions:

- Understand the terms, conditions, and any limitations for each offer or benefit to ensure you meet the requirements for rewards.

Strategic Timing:

- Time your purchases to coincide with available offers or bonus points periods to maximize benefits.

Balance Spending and Rewards:

- Avoid overspending solely to earn rewards. Balance your spending to suit your budget while taking advantage of available benefits.

Review Your Rewards Balance:

- Regularly review your rewards balance and track the progress towards specific goals or rewards to optimize redemptions.

By following these tips, users can make the most of rewards, offers, and benefits available through the Chase Mobile App, ensuring they leverage available perks and maximize the value of their spending and rewards programs.

Integrating other Chase services within the app (e.g., credit cards, investment accounts)

Integrating other Chase services within the Chase Mobile App allows users to manage a spectrum of financial activities seamlessly. Here’s a detailed explanation of how to integrate additional services such as credit cards and investment accounts:

1. Credit Cards Integration:

- Linking your Chase credit cards to the app provides a comprehensive view of your credit card accounts, allowing you to manage balances, payments, transactions, rewards, and benefits within a single platform.

2. Benefits of Credit Card Integration:

- Check balances, review recent transactions, and monitor available credit limits for all linked credit cards.

- Access reward points or cashback details, redeem rewards, and view current bonus offers associated with your credit cards.

- Set up alerts for credit card transactions, ensuring you’re promptly informed about any unauthorized or significant activities.

3. Investment Account Integration:

- Integration with investment accounts within the app gives you visibility and control over your investment portfolio, including stock holdings, mutual funds, retirement accounts, and other investment instruments.

4. Benefits of Investment Account Integration:

- Track and manage investment performance, view portfolio balances, and review transaction histories to stay informed about your financial investments.

- Execute investment transactions, such as buying or selling stocks or mutual funds, managing retirement contributions, or adjusting your investment portfolio.

5. Consolidated Financial View:

- Having credit cards and investment accounts integrated into the app offers a consolidated view of your overall financial situation, enabling you to manage both day-to-day spending and long-term financial goals from one platform.

6. Utilize App Tools and Features:

- Leverage tools within the app designed for investment analysis, portfolio management, and credit monitoring to make informed financial decisions.

Tips for Efficiently Integrating Additional Chase Services:

Complete Integration Process:

- Follow the app’s instructions to link credit cards and investment accounts thoroughly to ensure complete integration.

Regular Review and Monitoring:

- Continuously review credit card transactions, investment performances, and account balances within the app to stay on top of your financial activities.

Utilize Available Tools:

- Take advantage of any specific tools or features offered within the app for managing credit cards and investment accounts.

Stay Informed:

- Keep informed about any changes or updates to the services integrated into the app to maximize their benefits.

Integrating other Chase services, such as credit cards and investment accounts, into the Chase Mobile App streamlines financial management, providing users with a centralized platform to oversee a range of financial activities efficiently. This integration enhances convenience, offers comprehensive insights, and empowers users to make more informed financial decisions.

if you’re ready to take your app idea to the next level, consider harnessing the immense potential of India’s app development ecosystem. With a diverse talent pool, cutting-edge technology, and a track record of success, you can trust Indian app developers to turn your vision into a reality.